Mastering Your Budget: Tips for Financial Success

Learn how to take control of your finances with our comprehensive guide on mastering your budget for lasting financial success.

Understanding Your Financial Landscape

Mastering your budget begins with a clear understanding of your financial landscape. Start by taking a comprehensive look at your income, expenses, debts, and savings. It's crucial to know where your money comes from and where it goes. Track your spending habits for a month to identify patterns and areas where you can cut back. This will give you a realistic picture of your financial situation and help you set achievable goals. Remember, a budget is not just a restriction but a tool to help you manage your finances more effectively and align your spending with your priorities.

Setting Realistic Financial Goals

Once you have a clear understanding of your financial situation, the next step is to set realistic financial goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Whether you aim to pay off debt, save for a down payment on a house, or build an emergency fund, having clear goals will give you direction and motivation. Break down your larger goals into smaller, manageable steps. This makes the process less overwhelming and allows you to celebrate small victories along the way. Consistently review and adjust your goals as your financial situation evolves.

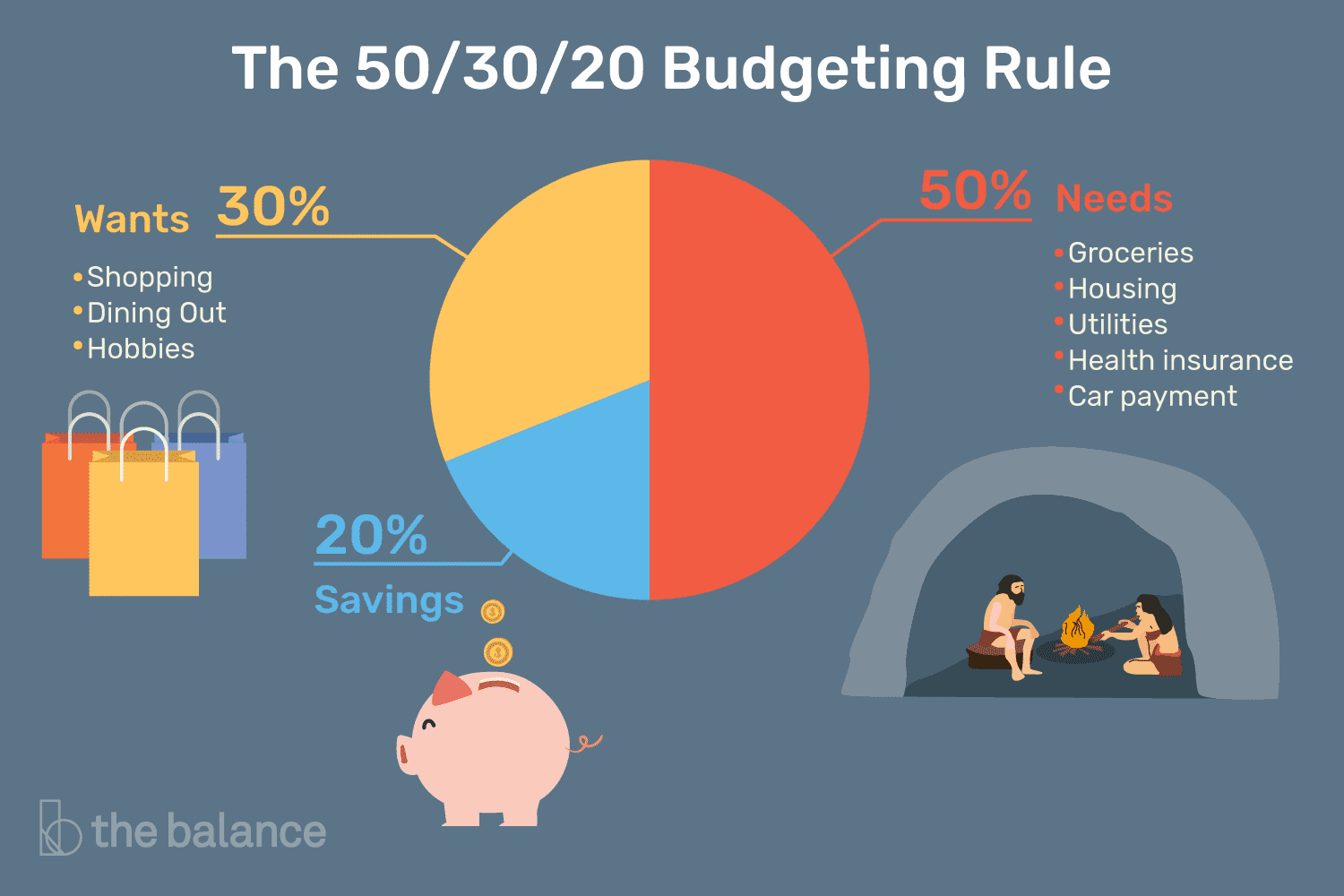

Creating a Detailed Budget Plan

A detailed budget plan is the backbone of financial success. Start by listing all your sources of income and categorizing your expenses into fixed (rent, utilities) and variable (groceries, entertainment). Allocate a portion of your income to each category, ensuring you prioritize essentials and savings. Use budgeting tools or apps to help you stay on track. Remember to include a category for unexpected expenses to avoid derailing your budget. Regularly review your budget to ensure it aligns with your financial goals and make adjustments as needed. A well-planned budget not only helps you manage your money but also reduces financial stress.

Building an Emergency Fund

An emergency fund is a crucial component of financial stability. It acts as a financial cushion during unexpected events such as medical emergencies, car repairs, or job loss. Aim to save at least three to six months' worth of living expenses in an easily accessible account. Start small if necessary, and gradually increase your savings over time. Consistently contribute to your emergency fund, even if it's a modest amount each month. Having this safety net will provide peace of mind and prevent you from going into debt during unforeseen circumstances. An emergency fund is a vital step toward achieving long-term financial success.

Practicing Financial Discipline

Financial discipline is essential for sticking to your budget and achieving your financial goals. This involves making conscious spending decisions and avoiding impulse purchases. One effective strategy is the 30-day rule: if you want to make a non-essential purchase, wait 30 days to see if you still want it. This helps curb impulsive spending and encourages thoughtful decision-making. Additionally, regularly review your financial progress and adjust your budget as needed. Celebrate your successes, no matter how small, to stay motivated. Practicing financial discipline will not only help you achieve your goals but also cultivate healthy financial habits for the future.